Here’s a simple question. What are the 2 key factors to great customer experience?

Well, the simple answer is customer service and purchase ease. After all, ensuring a smooth buyer journey results in more conversions for your business.

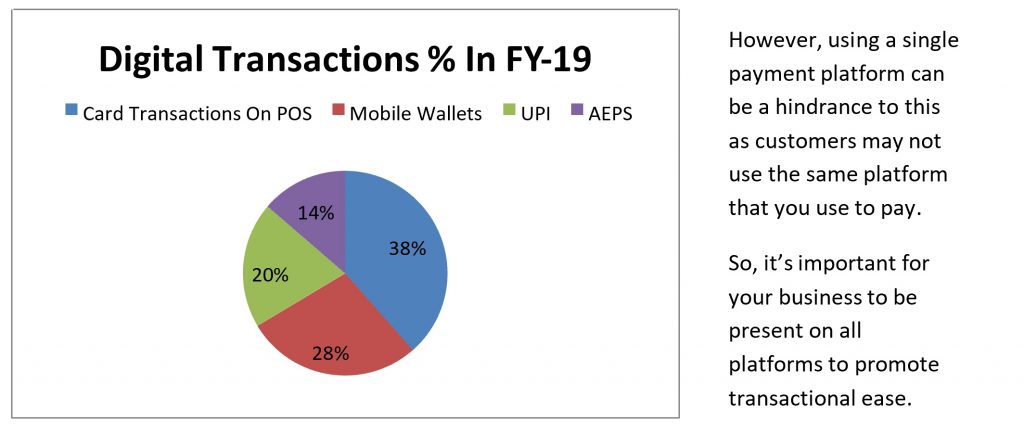

Customers do not just need variety in what they buy but also how they pay.

Hence a diversified business payment model which includes several ways to pay is crucial to any business today.

This is where omnichannel payment solutions come into the picture.

“An omnichannel payment solution provides an integrated payment acceptance platform for all business verticals using various payment methods while providing additional services like invoicing, business analytics, inventory solutions, delivery platforms, CR, etc.”

But Why Is the Single Payment Method Not Enough?

As a business, there’s a great deal of effort that goes into the sales and marketing of your product. Therefore, you would want to see your customer complete their buyer journey with ease and efficiency.

What’s more,

“Not being available on even one of the digital platforms can lead to a drop in sales and profits.”

With an increasing number of Indians using different payment methods, having an integrated payment model like omnichannel payment solutions is the way forward for business success.

So Which Payments Channels Should My Business Have?

There are 3 main factors you should consider when choosing your payment channels; transaction ease, customer requirements, and your insight needs. Depending on these, you can choose the following channels that best fit your needs:

- Android POS Terminals

Android POS terminals are becoming a standard product for any business or enterprise. Along with carrying out payment transactions, these modern swipe machines also integrate all kinds of third-party software solutions like billing, ticketing, account management, collections management, and inventory management. These Android POS machines accept contactless card payments and a range of payment modes like wallets, UPI, and QR codes. Advanced analytics and real-time transaction information through mobile applications and merchant portals give them an edge over conventional POS machines. Easy API integration with HOST solutions makes this a hot product among the new-age retailer community.

These Android POS machines make life easy for retail, restaurant chains, and supermarkets as they streamline checkouts which save time, money, and effort.

- Pay By Link

Pay by link provides a convenient and seamless payment experience to consumers who wish to use digital payments. By sending a link containing invoices via email, SMS, or WhatsApp, businesses can increase the options for payment and reduce turnaround time for payment transactions. This method has been used extensively in the education segment where they are used to complete fees collections and in SMEs for collection of outstanding payments from their customers. Overdue subscription collection also becomes easy with this method. This method of payment is gaining more popularity as clients are put under travel restrictions and social distancing becoming the norm.

Pay by link is becoming a staple across various industries and verticals. They are particularly popular with educational institutions, NBFCs, enterprises, and the E-commerce sector for their efficiency and security.

- UPI

As a real-time payment system, UPI simplifies digital transactions. Using static or dynamic QR codes, UPI allows transactions to be carried out safely with just one click. This is the most sought-after payment option in P2P as well as P2M segments in recent times. Almost all small ticket size payments have been moved to this platform. Business communities have adopted this product on a mass scale as it is proving to be a boon for street merchants who don’t need to invest heavily in digital payment acceptance. A Static QR displayed in the shop is enough for accepting UPI payments.

Another huge advantage of UPI is its flexibility and ease of use. UPI is easy to install and the availability of various apps makes it a very popular payment option.

These factors make UPI a popular payment method across businesses and verticals like QSR segments and enterprise chains.

- Tap & Pay

The new normal puts an emphasis on safety first. In the world of payments, that means contactless transactions. Contactless enabled cards are the safest mode of payment and can be done through a POS machine that accepts these cards. New-age Android-based POS devices are capable of these features.

As transactions are carried out with a simple tap, tap & pay system results in better customer experience. In fact, using this method, there is absolutely no physical touch from the customer’s end creating a sense of safety while paying during the pandemic. This is particularly useful across all the verticals as they help speed up transaction efficiency.

Using an omnichannel payment solution for your business opens up new avenues for smooth purchases and easy checkouts on any payment platform. It’s an easy, smart, and simple way for your business to get paid.

To know more about omnichannel payments and which one would be best for your business, please contact us @https://www.ezswype.com/contact-us.php

Be the first to comment